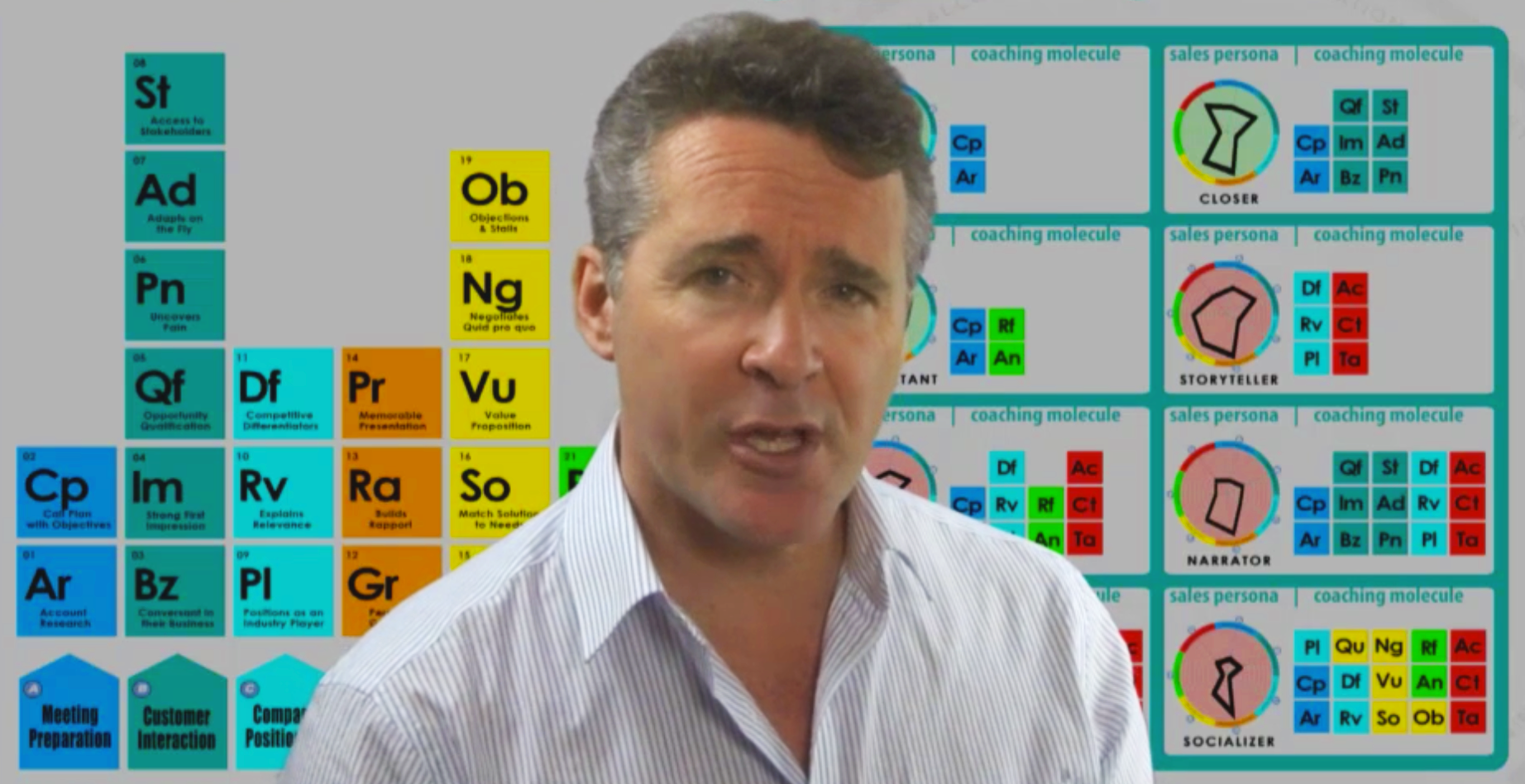

The original Sales Laboratory

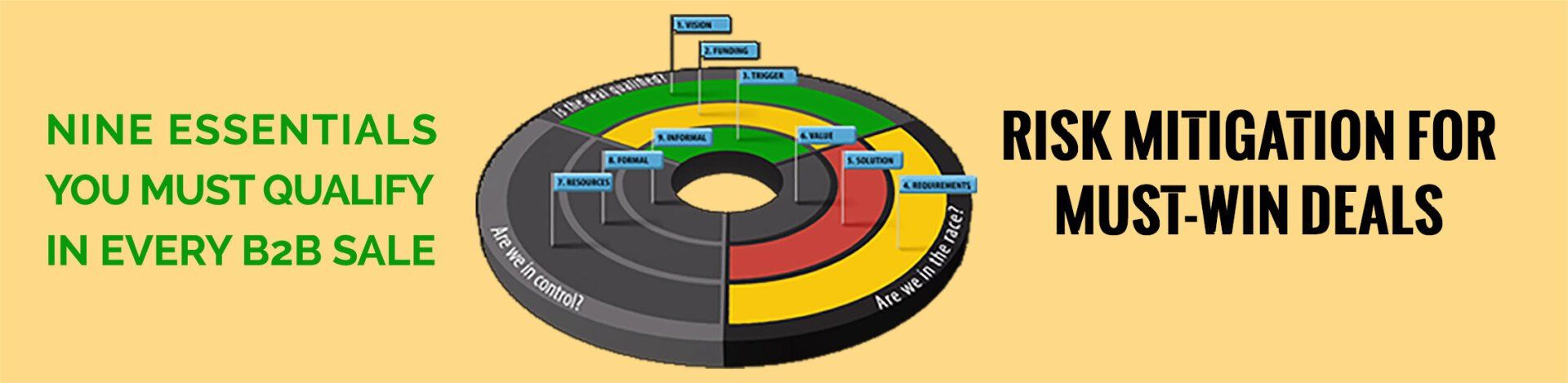

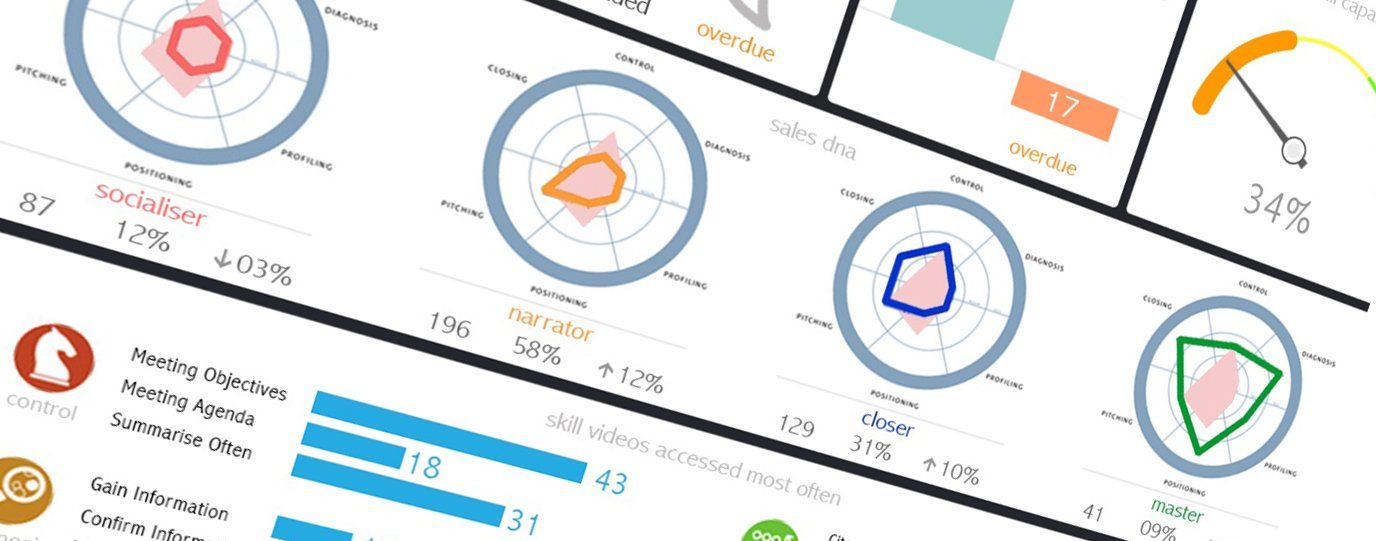

We audit your Sales organization, reveal its strengths and gaps, then deliver bespoke training, coaching and change management to lift its processes, people and profits. Since 1997, SalesLabs clients in 50 countries have won $50 Billion more than they thought possible by applying our research-based and award-winning approach.

Sell more

Grow faster

Field tested

Science-based

Client feedback